Medicaid Risk Adjustment Explained-A Guide for Coders and Healthcare Providers

With the Centers for Medicare & Medicaid Services (CMS) shift towards the updated Medicare Advantage Risk Adjustment Model the Medicaid managed care organizations (MCOs) and providers are facing a pivotal transformation in the way they contract, their evaluation and reimbursements. The emphasis is no longer simply on treating patients, but on accurately capturing the complexity of each patient’s health profile. A single missed diagnosis, an under-documented chronic condition, or incomplete encounter data can directly impact a provider’s reimbursement and audit risk.

With the states also expanding their own risk adjustment models to include behavioral health, social determinants, and chronic disease clustering, coders and providers must now work in unison to ensure documentation reflects the full clinical picture. In this blog let see how RCM partners like Shoreline Healthcare Technologies are proving their indispensable coding expertise, with AI-powered analytics, and audit-ready compliance frameworks that helps providers to navigate the expanding landscape of Medicaid risk adjustment.

What Is Risk Adjustment in Medicaid?

Risk adjustment is the method of calculation used to determine the appropriate amount to pay a health plan or provider, based on the patient's health status, their anticipated use of healthcare services, and the associated costs. The primary goal is to ensure that the payments received by health plans accurately reflect the health status and risk profiles of their members and that Medicaid Managed Care Organizations (MCOs) are compensated fairly based on their members health conditions. It simply means plans serving sicker or higher-risk populations receive higher payments, while those serving the healthier populations receive less amount.

Unlike Medicare Advantage (which relies on CMS-HCC models), Medicaid programs are state-administered and use different risk adjustment models. Listed below are few models and the states they serve.

| Chronic Illness and Disability Payment System (CDPS) | California and Nevada |

| Clinical Risk Groups (CRG) | New York |

| Adjusted Clinical Groups (ACG) | Maryland and Minnesota |

| Medicaid-specific hybrid models | Texas, Florida, and Ohio |

Each of these models categorizes beneficiaries by their chronic conditions, demographics, and utilization patterns and estimate the cost of care.

How Medicaid Differs from Medicare in Risk Adjustment?

CMS regulates the Medicare programs directly using the standard HCC model, whereas state Medicaid agencies manage their own risk adjustment methods with state-specific systems like CDPS, CRG, or ACG considering the factors like social determinants of health (SDOH) and behavioral health conditions, they also conduct audits through Managed Care Organizations (MCOs).

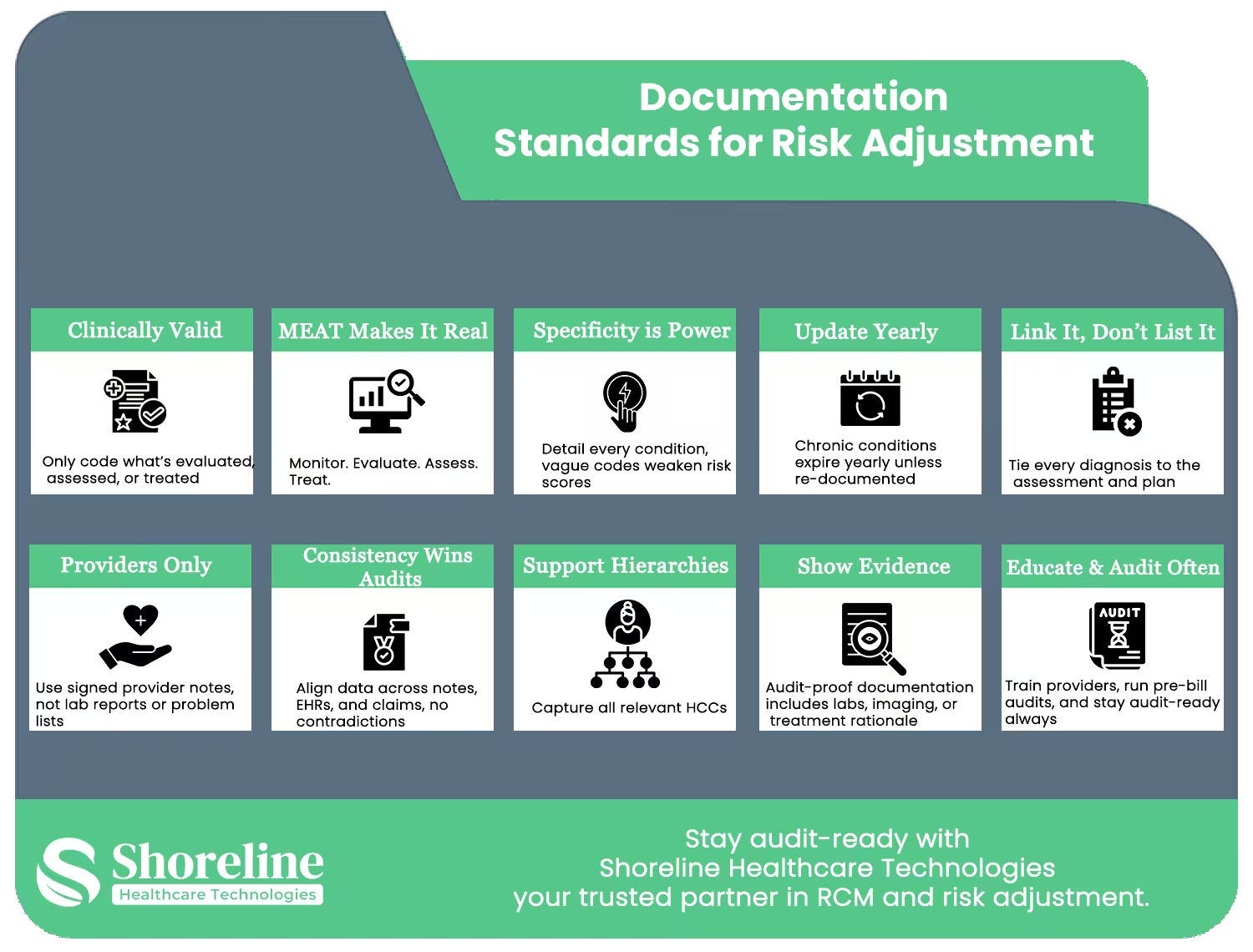

Documentation Standards for Risk Adjustment

➢ MEAT Compliance (Monitor, Evaluate, Assess, Treat):

Each diagnosis must show clear evidence of being monitored, evaluated, assessed and treated during the encounter to be valid for risk adjustment.

➢ Provider Affiliation:

Only qualified healthcare providers can perform the diagnosis and sign all the documents with date.

➢ Specific and Accurate coding:

Assign the most specific ICD-10 code possible to indicate the patient's status.

➢ Document Clinical Evidence:

All the conditions that are coded have to be accompanied by appropriate clinical notes like lab work, medications, or provider evaluation.

➢ Validate Chronic Conditions:

Prevalent conditions such as diabetes, hypertension, and COPD need to be screened once a year for active risk score.

➢ Status and Severity:

State the stage, level of control or acuity (e.g., acute, chronic, controlled) to justify the risk stratification.

➢ Uniformity Across Records:

Diagnoses are required to be consistent across all sections like progress notes, problem lists, and assessment plans for audit readiness.

➢ Avoid “History Of” Coding Errors:

Do not code for inactive or resolved conditions unless continuous treatment or monitoring is required.

➢ Prompt and Readable Entries:

Soon after each the encounter enter all the records thoroughly in a readable format for the purpose of audit.

➢ Optimized Electronic Health Record (EHR):

Coders need to ensure that the macros and templates in the EHR do not auto-fill inactive diagnoses which may risk for non-compliance.

Operational excellence through smarter workflows

To maintain compliance and improve reimbursements coders must play an active role which is achieved by education, workflow optimization, and sustained training.

Education and Collaboration: Building a Unified Documentation Culture

- ✔ Coders should regularly communicate with the providers to check whether the medical records reflect the patient’s health status and meet audit-ready standards.

- ✔ Flag unclear or incomplete diagnoses, and prompt providers to document specificity and clarify diagnostic ambiguities.securely.

- ✔ Educate clinicians on the value of proper documentation and promote awareness to enhance the quality of reporting to prevent future denials.

- ✔ Review the previous RADV or internal audits findings and identify the documentation gaps and plan for corrective strategies.

This would provide insights to the providers about how documentation can impact reimbursement, and coders can gain clinical knowledge leading to more accurate coding decisions.

Workflow Redesigning Accuracy into Every Stage

Operational excellence in risk adjustment requires a streamlined, proactive workflow that captures complete data across every phase of the patient encounter. We can close the loop with a three-step model.

➢ Pre-Encounter Validation:

Verify eligibility and prior chronic conditions before each visit enabling to enter the encounter with complete context.

➢ Documentation Review During Service visit:

Employ real time tools like Natural Language Processing (NLP) or EHR with built in coding prompts to identify errors or incomplete MEAT components while documenting.

➢ Post-Encounter Quality Check:

Review the entire physicians note for accuracy and specificity of the codes, also check for compliance in risk adjustment standards after each encounter to ensure claim reflects the true clinical complexity of the patient.

By integrating these automation and structured review points, healthcare organizations can reduce their denials and accelerate claim submission while maintaining high audit scores.

Continuous Training for Compliance and Adaptability

The Medicaid risk adjustment models vary across each state, so that coders must keep themselves updated on the regulatory changes. We at Shoreline Healthcare Technologies offers specialized, role-based training programs that empower coding teams to

- Understand the State-Specific Models

- Navigate Medicaid Audit Rules

- Identify Documentation pitfalls

- Integrate SDOH and Z-Codes

Strategic Partnership with Shoreline Healthcare Technologies for Sustained Success/h3>

The complexity and variability of state Medicaid programs require a partner with demonstrated scale, specialization, and an unwavering commitment to technology and integrity. Shoreline Healthcare Technologies operates across all states of US including California, Texas, Florida, New York, and Illinois, showcasing the geographic reach and capability necessary to navigate diverse state regulatory landscapes.

Shoreline’s mission is centered on being a trusted and valued healthcare partner, offering advanced cloud-based Revenue Cycle Management (RCM) services with dedication and integrity. Our comprehensive services cover all critical areas starting from Eligibility & Benefits Verification, claim submission, denial management, Credentialing & Enrollment, and expert Coding in ICD-10, CPT, and Hierarchical Condition Categories (HCCs).

We at Shoreline Healthcare Technologies are committed to the future of medical billing through investment in specialized personnel and cutting-edge technology. This strategic approach helps Medicaid MCOs to attain the state-specific coding precision and close the revenue leakage gaps.

FAQs

Q1. What is the main goal of Medicaid risk adjustment?

+The main goal of Medicaid risk adjustment is to ensure fair payments to Medicaid managed care plans based on members’ health risk and disease burden, preventing plans from being penalized for covering high-cost patients.

Q2. Why is Medicaid risk adjustment more complex than Medicare?

+In Medicaid each state defines its own risk models, variables, and documentation requirements whereas Medicare follows a uniform CMS-HCC model.

Q3. Can AI replace human coders in Medicaid risk adjustment?

+No. AI can be used to identify potential documentation gaps; however, coders are essential for clinical judgment, validation and maintain the compliance.

Q4. How does Shoreline Healthcare Technologies support risk adjustment?

+We at Shoreline Healthcare Technologies provides full RCM support to providers across all states of US from documentation validation to audit defense, helping them to maximize reimbursements and maintain compliance.

Q5. Is ShorelineMB the same as Shoreline Healthcare Technologies?

+Yes, ShorelineMB.com is the official website of Shoreline Healthcare Technologies, a leading provider of medical billing and RCM services.

Contact Shoreline today to explore our comprehensive Revenue Cycle Management services.