How to Cut Your AR Days Using Advanced Claims Scrubbing

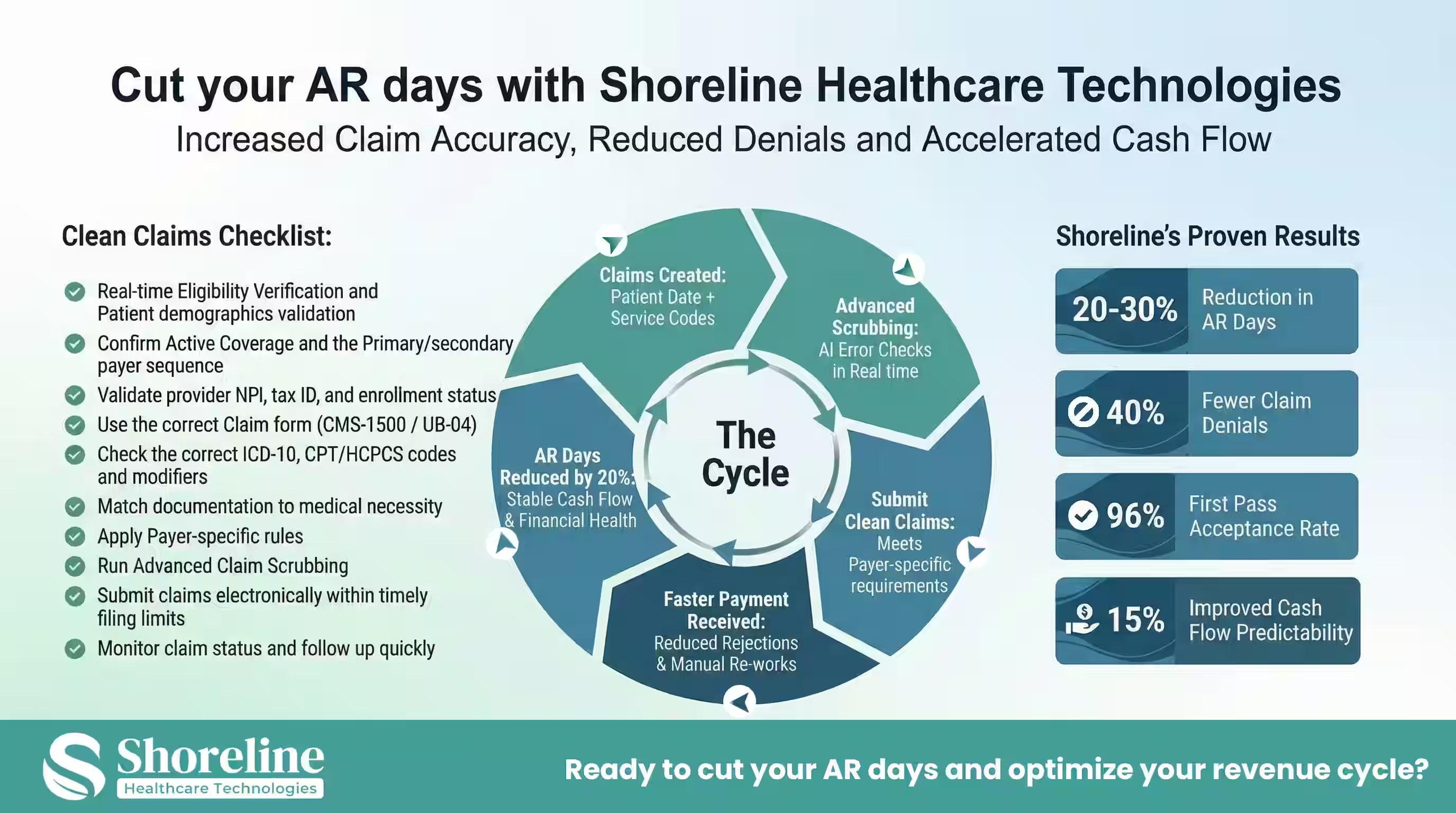

The performance of Accounts Receivable (A/R) has become one of the most visible indicators of a high-performing revenue cycle. In the fast-paced healthcare environment, days in A/R isn’t just a number but reflects the claim quality, payer responsiveness, operational discipline, and financial predictability. So, reducing the days in accounts receivable (AR) has become a survival strategy rather than a financial goal. Long AR cycles can drain the cash flow, delay reimbursements, and hurt the operational stability where the organisation spend countless hours fixing the rejected or denied claims. Apart from these with each delay the cost of collecting the payment increases disrupting the financial health. This blog explains the key to solve this persistent challenge using claims scrubber, a modern, technology-driven approach that ensures every claim submitted is clean, accurate, and compliant with the payer-specific requirements that would ultimately reduce the days in A/R by at least 20%. It also highlights on how advanced scrubbing when done correctly eliminates rework, accelerates adjudication, and turns claims into cash faster.

Understanding the Days in Accounts Receivable

Accounts receivable (AR days) measures the number of days a healthcare organization takes to collect the payment after rendering the service. The shorter the cycle, the healthier the organization’s cash flow.

Why are the days in A/R considered as the most visible symptom of RCM breakdown?

Days in Accounts Receivable is often treated as a back-end problem, but in reality, it is the outcome of multiple upstream failures, that would have been raised because of the claims entering the system with missing authorizations, incorrect coding, payer mismatches, or medical necessity gaps, which doesn’t just get denied but stall, bounce, and age increasing the AR Days straining budgets and slowing revenue cycle management.

Reducing AR days means implementing smarter, faster, and cleaner claim submission processes. That’s where advanced claims scrubbing technology comes in.

What is Advanced Claims Scrubbing?

Advanced claims scrubbing is the process of using AI, automation, and real-time validation to identify and correct errors in the claims before they reach the payer. It examines the claims for missing codes, mismatched data, and gaps in payer compliance. It goes far beyond surface-level edits and applies intelligence, clinical logic, and historical denial patterns to the claims. The advanced scrubbing done correctly,

- ➢ increases the rate of first-pass acceptance

- ➢ reduces the denial volume

- ➢ shortens adjudication cycles

- ➢ lowers manual follow-up

- ➢ directly cuts Days in A/R

The Four Pillars of Advanced Claims Scrubbing

Traditionally, claim scrubbing was done manually which might be time-consuming and error prone. But nowadays with intelligent automation tools thousands of claims are analyzed in seconds by flagging the potential issues instantly, reducing the administrative burden and ensuring clean claims submission on the very first try. These advanced scrubbing systems integrate real-time eligibility verification and automatically confirm insurance coverage, patient data, and authorization requirements preventing claim rejections before they occur. This results in faster payment cycles and more predictable cash flow.

Payer-Specific Scrubber Rules

Not all payers adjudicate claims the same way. Everyone have their own modifier rules, bundling logic, authorization requirements and local coverage policies. Claims submitted without accounting for these differences often end up in denial queues. Advanced scrubbing tools use payer-specific rule engines, that includes

- ➢ Commercial vs Medicare vs Medicaid logic

- ➢ Plan-level variations

- ➢ MAC-specific LCD enforcement

- ➢ Facility vs professional billing differences

This reduces the need for retries, which directly cuts Days in A/R.

How does payer-specific edit impact the Days in A/R?

Claims that are aligned with the payer-specific rules moves quickly through adjudication at the first time, reduces the payment delays and eliminates the need for manual follow-up for the rejections and pending statuses. By submitting consistent, accurate, and compliant claims we gain trust with the payers. It reduces friction, accelerates adjudication, and improves the long-term payer relationships. Meeting the payer-specific rules not only shortens the AR days but also boosts the overall performance of the revenue cycle.

With end-to-end revenue cycle management services that include rules-based scrubbing aligned with payer policies, Shoreline Healthcare Technologies ensures claims are structured to meet the expectations of the individual payer, reducing back-and-forth rejections with accelerated payments.

Claim Edit Intelligence

Deeper than payer rules there are thousands of logical edits that often trip up billing teams. Advanced scrubbing applies multi-layered claim edits that catches issues that have been missed by the traditional systems. They include high-impact claim edits like

- ➢ ICD-10 specificity validation

- ➢ Modifier sequencing logic

- ➢ NCCI bundling enforcement

- ➢ Place-of-service mismatches

These edits prevent claims from entering manual review queues which is a major contributor to A/R aging.

Prior Authorization logic embedded into scrubbing

Missing or incorrect authorizations are among the largest drivers of delayed reimbursement. Claims submitted without valid authorization often sit unpaid for weeks before denial. Catching these issues before submission eliminates the entire A/R cycles. Advanced scrubbing integrates this authorization logic directly into the claim review process and checks them for the

- ➢ Requirement of the authorization for the CPT\ payer\POS

- ➢ Validity of the authorization for the date of service

- ➢ Alignment of the authorized CPT with the billed CPT

- ➢ Has the authorization limit been exceeded?

Fixing these issues before submission can prevent entire claim cycles from stalling.

Predictive Rejection Analysis

Predictive rejection analysis uses historical denial data, payer behavior patterns and service-line risk scoring to predict which claims are most likely to be denied or delayed.

How Predictive Scrubbing Works

- ➢ Claims are risk-scored before submission

- ➢ High-risk claims are routed for correction

- ➢ Low-risk claims are fast-tracked

This prioritization can save days or even weeks off the average A/R.

Integrating Advanced Scrubbing into Your Revenue Cycle Management

- ➢ Assess current AR performance and identify the key bottlenecks.

- ➢ Integrate advanced scrubbing tools into your billing system.

- ➢ Enable real-time eligibility checks and payer rule updates.

- ➢ Monitor performance metrics continuously.

- ➢ Empower staff through continuous training.

To maximize impact, advanced scrub rules should be embedded at multiple integration points:

- ➢ Before Claim Creation: After coding and charge capture to ensure clinical and financial data alignment.

- ➢ Before Batch Submission: After eligibility and authorization checks to catch the payer mismatch issues.

- ➢ Before Re-submission: For corrected claims to check whether the corrections meet the real payer requirements.

Right from the front-end eligibility verification till meeting the payer-specific compliance and AR follow-up, every stage plays an important role in reducing the days in accounts receivable. With layered approach we can avoid the repetitive errors and make each claim have the highest probability of payment on the first pass. By partnering with Shoreline Healthcare Technologies hospitals and healthcare organizations can improve their operational efficiency with proven RCM strategies and have a predictable cash flow that strengthens their performance across the entire revenue cycle.

The Shoreline Advantage: Real-Time Data Insights for AR Management

We at Shoreline Healthcare Technologies provides real-time dashboards, predictive analytics, and error insights allowing billing teams to monitor claims performance and reduce AR days proactively. Explore our case study a compelling example of how advanced claims management have reduced the AR days for a Neurospine specialty facility in Wisconsin who partnered with Shoreline Healthcare Technologies during a critical billing system disruption. When the facility’s practice management software vendor unexpectedly went bankrupt, over $6 million in accounts receivable was at risk. We implemented a rapid recovery strategy that ensured billing continuity, applied payer-specific validation, and maintained clean claim submission throughout the transition. The result was 96% first pass claim acceptance, recovery of $2.8 million in aged AR, and uninterrupted cash flow this clearly demonstrates how payer-aware claims processing and disciplined AR management directly support faster reimbursement and healthier AR days.

FAQs

Q1. Why does the traditional claims scrubbing methods fails to reduce days in A/R?

+The traditional claims scrubbing methods focus only on the basic formatting, generic CPT–ICD matching and missing-field checks which misses the issues that actually drive denials and payment delays. This allows the high-risk claims to pass through resulting in rejection of claims after submission, forcing rework and extending the A/R cycle instead of shortening it.

Q2. How does Shoreline Healthcare Technologies help accelerate reimbursements using advanced claims scrubbing?

+At Shoreline Healthcare Technologies we combine advanced scrubbing automation with certified billing experts, claims strategists, and payer relationship specialists who manage scrubbing and follow-up workflows efficiently. Our team ensures claims move through adjudication more smoothly, reducing lag and accelerating reimbursements.

Q3. What is the ideal number of days in accounts receivable for healthcare organizations?

+For a healthcare organization to perform well and stabilize their cash flow they must aim for 30–40 days in accounts receivable. AR days consistently above this might indicate issues with claims processing, payer-specific compliance, or denial management.

Q4. What role does clean claim rate play in reducing AR days?

+Clean claim rate is one of the strongest predictors of AR performance. A higher clean claim rate means:

- ➢ Fewer denials

- ➢ Less manual follow-up

- ➢ Faster payer adjudication

Organizations that consistently submit clean claims typically see 20%–30% lower AR days compared to peers with poor first-pass acceptance.

Q5. Is ShorelineMB the same as Shoreline Healthcare Technologies?

+Yes, ShorelineMB.com is the official website of Shoreline Healthcare Technologies, a leading provider of medical billing and RCM services.

Contact Shoreline Healthcare Technologies today to optimize your Revenue cycle and Reduce your AR days.