The Checklist for Patient Financial Responsibility Communication

Over the past two decades the percentage of workers who are enrolling in the high-deductible health plans is growing sharply, in the United States. Due to this rapid growth of HDHPs and increased cost-sharing by the insurers patients are forced to bear a larger and more unpredictable share of their medical costs. Though these plans were designed to reduce the premium costs they have resulted in substantially higher out-of-pocket obligations. Providers are required to engage with their patients directly to collect majority of their payment, as collections are being increasingly tied to them rather than the third-party payers. So there arises the need for a clear, proactive communication with the patients about the costs, unless which the providers must face the higher rates of unpaid balances, increased bad debt ratio, and longer days in accounts receivable. In this blog let us explore the checklist for an effective patient financial responsibility communication which not only enhances the patient experience but also helps to optimize the financial performance of a healthcare organization for their long-term sustainability.

What do mean by Patient Financial Responsibility in Healthcare?

The portion of the healthcare cost that the patients are obligated to pay based on their legal contract with the insurance company. This includes

- • Deductibles

- • Copayments

- • Coinsurance

- • Non-covered services

- • Self-pay balances

Why does a clear financial communication matter the most?

Without a clear and transparent explanation about the costs upfront patients often gets confused with the unexpected bills, that damages trust and delays payment. A clear, compassionate healthcare financial responsibility communication helps to reduce these delays, strengthening the compliance and regulations and enhancing the patient trust. Moreover, patients who understand their costs are more likely to pay on time that reduces the collection costs and improve patient satisfaction scores. An effective financial communication not only empowers the patients but also supports the financial health of the organizations.

The Core Elements of Effective Patient Financial Responsibility Communication

Patient Billing Transparency and Cost Explanation

Transparency begins with clarity. Give a clear breakdown of their insurance coverage and payment expectations well before rendering the treatment.

A transparent billing statement must answer these three questions:

- What am I paying for? (services rendered)

- What did my insurance cover?

- What remains my responsibility?

Always prioritize transparency and give a clear communication to build trust and prevent disputes or delayed payments. It also helps to improve patient satisfaction and align with the No Surprises Act compliance.

Communicating the Out-of-Pocket Costs Early

Always discuss the out-of-pocket costs before the services are rendered. This proactive approach and upfront clarity reduce confusion and improves collection rates.

Shoreline Healthcare Technologies’ HIPAA compliant virtual assistants walk patients through the expected copayments and deductibles, available financial assistance options, payment plans and early pay discounts right at the time of appointment scheduling, helping patients to take informed decisions before the care begins. Our patient-centric approach reflects our broader mission to modernize the revenue cycle operations through intelligent automation and deep domain expertise, that reduces confusion and improves upfront collections and patient trust.

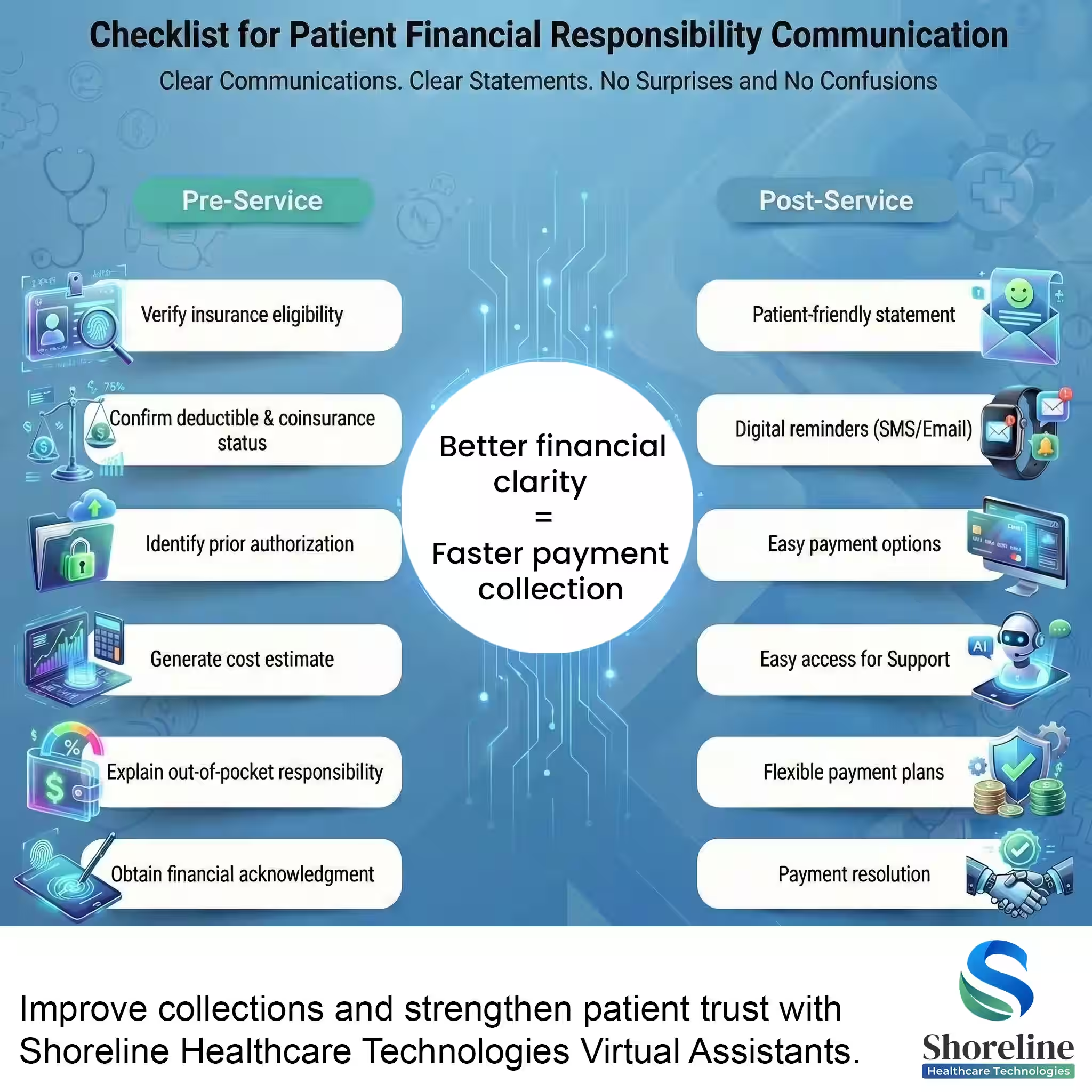

Phase 1: Financial Clarity Before Care (Pre-Service Communication)

The most effective healthcare payment responsibility workflow begins before the patient even walks through your door. The Pre-service communication sets the financial expectations that guide every downstream interaction. Any errors or omissions at this stage might lead to post-service disputes.

➣ Eligibility and Benefits Verification

- • Conduct a thorough eligibility and benefits verification during the scheduling process.

- • Confirm the patient’s active coverage to prevent downstream denials

- • Confirm deductible status (met vs remaining)

- • Identify copays and coinsurance percentages

- • Flag exclusions and non-covered services

➣ Pre-Authorization Clarity:

If a procedure requires prior authorization, complete the formalities and discuss the same with the patients so that they are aware of their insurance’s stance.

➣ The Patient Responsibility Estimation Process:

- • Provide a clear, written cost estimates.

- • Ensure the non-covered or self-pay patients receive a transparent healthcare pricing communication document.

- • Include professional + facility fees where applicable

- • Clearly explain that estimates are not final bills

Communicating patient out-of-pocket costs is much more effective when backed by data rather than "guesstimates."

➣ Obtain Financial Consent:

Make sure that the patients understand and agree to the financial terms before receiving the treatment. This includes getting signatures in the acknowledgment forms that aligns with No Surprises Act regulations.

➣ Communicating the Various Payment Options and Plans:

Explain the various payment options and available assistance programs that helps them for cost-savings. Provide the patients with flexible payment methods like credit cards, installment plans and online patient portals that would reduce their financial burden and improve collections.

Phase 2: Point-of-Service (POS) Payment Collection

- ✔ Collecting the co-pays at the time of check-in can prevent revenue leakage due to poor patient communication.

- ✔ Reinforce the previously shared estimates and explain payment expectations clearly. These upfront collections would improve the net revenue significantly.

Phase 3: Post-Service Communication

- ✔ Generate a simple, clear bill that clearly distinguishes what the insurance had paid and what is the balance amount that the patient owes.

- ✔ Use automated reminders (SMS/email) and maintain compassionate follow-up process.

Best Practices for Patient Billing Communication

- ✔ Use patient-friendly simple language avoiding the jargons.

- ✔ Set up communication through phone, portal, emails or SMS to create a positive patient experience.

- ✔ Adopt automated tools to deliver real-time cost estimates and digital billing reminders to improve engagement and streamline workflows.

We at Shoreline Healthcare Technologies helps providers with their patient financial responsibility communication by

- ✔ Automating the Front-End Financial Workflows like eligibility verification, cost estimation and authorization tracking

- ✔ We have a standardized financial counseling scripts and patient education materials.

Through our structured communications with the patients, we have helped a provider to recover nearly $800,000 in patient collections demonstrating how effective communication directly translates into revenue protection and growth. Our disciplined, patient-centric approach helps to reduce billing confusion, prevent revenue leakage, and strengthen the long-term financial performance.

FAQs

Q1. Why is patient financial responsibility communication important in the revenue cycle?

+Patient payments are increasing and are becoming a growing share of the healthcare revenue. So, providing a clear explanation of the incurring costs to the patients beforehand would be the best practice to reduce bad debt, billing disputes and payment delays to prevent the revenue leakage.

Q2. When is the right time to discuss about the patient financial responsibility?

+It is ideal to discuss about the patient financial responsibility during the early stages like appointment scheduling or the registration process. This early communication allows patients to prepare financially, ask questions, and explore the available payment options before getting the services. Thereby leading to better satisfaction and improved collection rates.

Q3. How does patient financial communication help in supporting the compliance with the No Surprises Act?

+A clear and written communication about the cost estimates at the upfront helps to understand their financial obligations and get informed consent before the care delivery. This prevents the unwanted disputes after receiving the treatment and stay in compliance with the No Surprise Act.

Q4. How does Shoreline Healthcare Technologies approach patient financial responsibility communication?

+The Virtual Assistants of Shoreline Healthcare Technologies have a proactive communication well at the front-end rather than following up after billing. They provide the patients with a clear financial counselling early during the scheduling or eligibility verification and get their financial consent. This helps patients to understand their financial responsibility before care is delivered, reducing the confusion and unpaid balances downstream.

Q5. Is ShorelineMB the same as Shoreline Healthcare Technologies?

+Yes, ShorelineMB.com is the official website of Shoreline Healthcare Technologies, a leading provider of medical billing and RCM services.

Contact Shoreline Healthcare Technologies today to optimize your Revenue cycle.