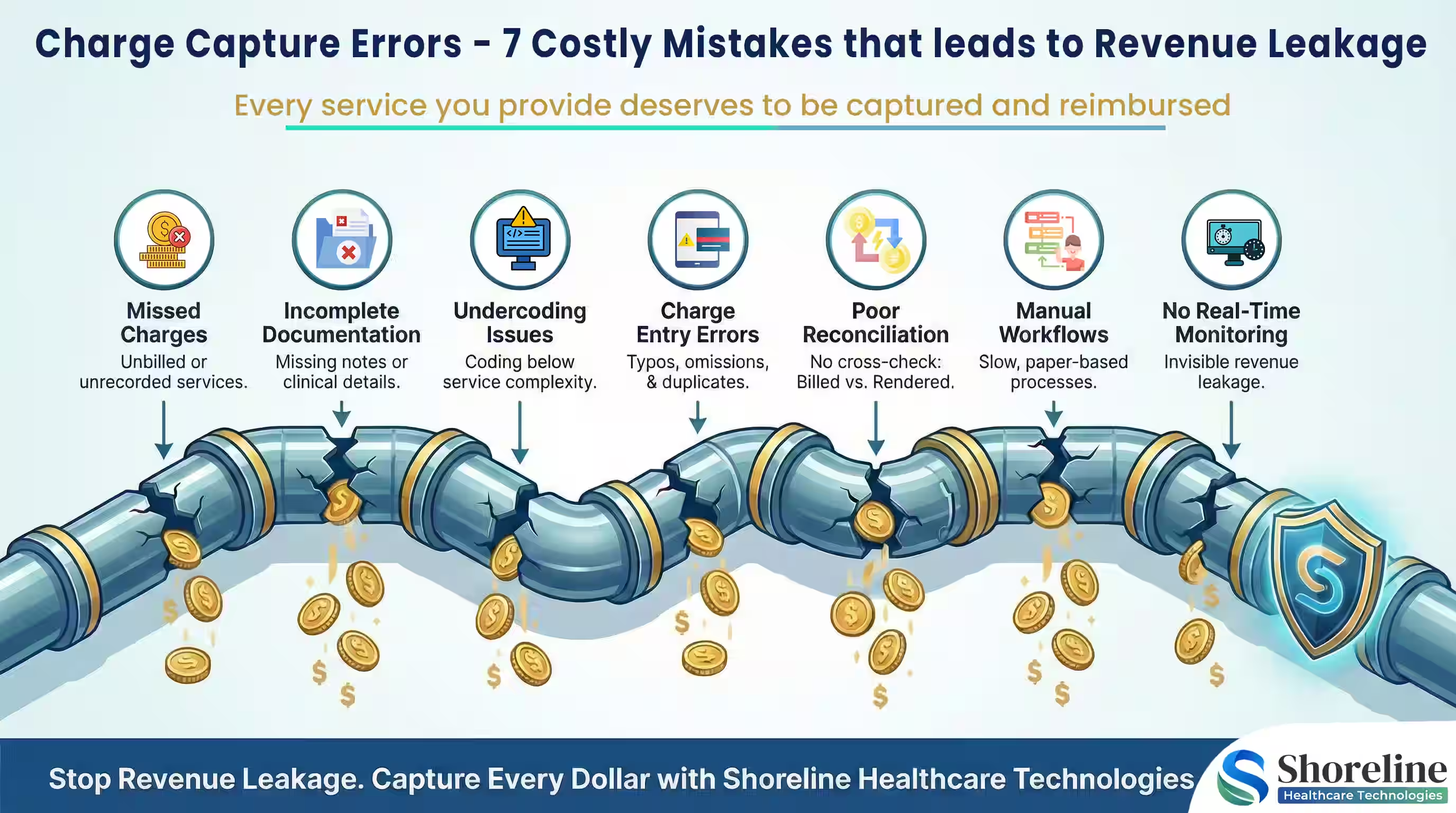

Charge Capture Errors the Costly Mistakes That Lead to Revenue Leakage

Healthcare organizations lose millions in legitimate revenue every year not because services weren’t provided, but because they were never captured, coded, or billed correctly. Charge capture errors, the losses that rarely show up as denials are among the leading causes of revenue leakage in healthcare. They quietly erode margins sitting at the intersection of clinical documentation, coding accuracy, and billing workflows. In this blog I have pointed out the 7 most common charge capture mistakes, explaining how they lead to underbilling and practical strategies to prevent them without increasing the compliance risk.

Understanding Charge Capture in Medical Billing

What do you mean by Charge Capture?

The charge capture is the process of recording and translating the clinical services provided to the patients into billable codes for reimbursement using the correct CPT/HCPCS codes, modifiers, and units with the help of accurate documentation. It ensures that every medically necessary service performed is billed fully and correctly so that providers get paid for the care they deliver.

Why is the Charge Capture Errors more dangerous than the actual denials?

Charge capture errors don’t result in denials but leads to underbilling that are invisible and do not appear on the denial dashboards or trigger payer feedback. Unlike denials, missed or under coded charges cannot be appealed once the claim is submitted. These errors silently accumulate across departments, creating a huge annual revenue leakage that remains unnoticed.

The key stake holders in the process of charge capture

Clinicians and providers who deliver care and document services at the point of care, forming the foundation for accurate charge capture.

Clinical documentation specialists for verifying the provider notes and conclude whether they are sufficient to support the billable services and coding requirements.

Medical coders for translating the clinical notes into the appropriate CPT, HCPCS, ICD codes and aligning them with modifiers and POS codes.

Charge entry and billing teams who validate and submit the charges for processing.

Revenue Cycle Management (RCM) leaders and compliance teams to monitor the correctness of the claims submitted, prevent revenue leakage, and manage audit risk.

Charge Capture gaps that trigger underpayments and audit risk

Let’s break down the seven most common charge capture errors that silently drain healthcare revenue and explore how to fix them.

1. Missed Charges in Medical Billing

Missed charges are the most common occurrence in outpatient settings and emergency departments where some minor services, procedures, supplies, or add-on codes are missed out and are not entered into the billing system.

- ➢ Implement an automated charge reconciliation system to compare the clinical notes against the billed charges to alert the missing charges on daily basis.

2. Under coding from Incomplete Clinical Documentation

Sometime the services are left unreported or assigned wrong code due to the lack of clear and complete clinical notes when the providers fail to record the full extent of services rendered.

- ➢ Conduct training to providers on the importance of clinical documentation and use EHR prompts to ensure all billable activities are captured. We can also set-up specialty-specific documentation templates that would benefit providers across various specialities and update them regularly to meet the compliance standards.

3. Medical Billing Undercoding

Undercoding occurs when the services provided are billed with the lower-level codes than the actual supported code due to the fear of audits, unclear documentation, or limited coder-clinician alignment. While undercoding reduces denial risk, it systematically suppresses legitimate reimbursement. Because claims are still paid, these losses rarely appear in denial or rejection reports. Over time, consistent undercoding across high-volume services leads to substantial revenue leakage.

- ➢ Conduct periodic audits and educate clinicians about compliant, accurate coding practices.

4. Failure to Capture Add-On and Ancillary Codes

Add-on codes are one of the largest sources of hidden revenue loss. These codes often account for significant incremental revenue however they’re frequently missed and are not reported, since they cannot be billed independently. These missed add-ons create a considerable amount of underbilling across common procedures resulting in revenue loss that never appears on denial or variance reports.

- ➢ Use charge capture tools and EHR edits to flag eligible add-on codes on selection of the appropriate primary procedure. Conduct periodic charge capture audits to identify the recurring gaps and correct them before revenue is lost.

5. Manual Workflows

Manual entry introduces the risk of inaccurate charge capture due to typos, data omissions, charges entered under the wrong encounter or incorrect units. Even a 1–2% manual error rate can result in major underbilling for high-volume practices.

We at Shoreline Healthcare Technologies have automated the charge entry by integrating the EHR-RCM systems with standardized charge entry rules & QA checkpoints before claim generation to reduce human error.

6. Delayed Charge Capture

Charges captured late are often never billed, especially if the claim has already been submitted, timely filing limits are exceeded or the encounter is closed in the EHR. These late charges often result as permanent revenue loss.

We at Shoreline Healthcare Technologies have automated systems to alerts for unposted encounters and with real-time dashboards on timely filing risks so that we are able to maintain a charge lag of less than 72 hours.

7. Lack of Real-Time Monitoring & Poor Charge Reconciliation

Without proper charge reconciliation and proactive monitoring, charge capture errors accumulate over time, creating compounding revenue gaps.

- ➢ Generate daily reconciliation reports with AI-powered analytics to cross-check billed vs. rendered services, anomalies in billing pattern and to alert the billing teams the potential underbilling patterns.

Charge Capture Optimization Strategies for Healthcare Leaders

Addressing the charge capture errors is one of the most effective ways to achieve financial performance optimization and compliance.

Integrating EHRs and Billing Systems

One of the main reasons for missed charges in medical billing is the disconnection between Electronic Health Records (EHRs) and billing platforms. When these systems don’t communicate effectively, billable activities slip through the cracks. By Integrating the EHR with the billing or practice management system we can ensure that every charge generated in the EHR is automatically transferred to the billing queue, minimizing healthcare revenue leakage.

Educating Providers on Documentation and Compliance

Even the most advanced charge capture systems can’t overcome poor documentation. Educate providers on the documentation specificity, and the link between effective clinical documentation and reimbursement. Use real case examples of undercoding, missed charges, or CPT coding charge capture errors to make lessons practical and memorable. Use templates that support higher-level coding aligned with the payer requirements.

Leveraging AI and Automation

Modern charge capture technology now includes AI-driven automation, which identifies missing or inaccurate charges before claims submission. Machine learning algorithms can detect patterns of underbilling, charge entry errors, and documentation gaps in real time. These automated charge capture reduces manual work, improves accuracy, and helps prevent revenue leakage in medical billing while freeing up RCM teams to focus on higher-value tasks.

Charge Capture Is a Revenue Protection Strategy

Charge capture errors don’t just affect billing they quietly drain financial performance. By addressing these charge capture mistakes, healthcare organizations can reduce underbilling and improve financial predictability with long-term sustainability. At Shoreline Healthcare Technologies we don’t just fix your billing issues, but we engineer revenue integrity. We deliver reports on expected vs captured revenue analysis, provider-level underbilling trends with continuous improvement reporting, helping you to take your financial decisions upfront.

FAQs

Q1. What are the consequences of underbilling in Healthcare Industry?

+Underbilling directly reduces profit margins and provider compensation, as many physicians are paid based on relative value units (RVUs). It also leads to audit risks when inconsistencies arise between documentation and billing.

Q2. How can hospitals improve charge capture accuracy?

+By standardizing their workflows, improving provider documentation and using automation with routine charge capture audits hospitals can improve their charge capture accuracy.

Q3. How often should charge capture audits be performed?

+It is always best practice to conduct the charge capture reconciliation on daily basis with monthly audits. As regular audits help to identify the underbilling trends before significant revenue loss.

Q4. Can outsourcing help organizations reduce their revenue leakage?

+Yes. By outsourcing the charge capture process to specialized RCM partners like Shoreline Healthcare Technologies can benefit organizations by bringing advanced analytics, certified coding expertise, and continuous monitoring that many in-house teams lack. We also help to recover the hidden revenue without increasing the compliance risk.

Q5. Is ShorelineMB the same as Shoreline Healthcare Technologies?

+Yes, ShorelineMB.com is the official website of Shoreline Healthcare Technologies, a leading provider of medical billing and RCM services.

Contact Shoreline Healthcare Technologies today to optimize your Revenue cycle.