Denial codes can be a significant obstacle to successful reimbursement, and stands in the way of the practice’s revenue. A survey conducted by Experian Health in 2024, indicates that 84% of healthcare providers wish to cut down their claim denials and have kept it at the top of their to-do list. From this it is clear that minimizing denials isn’t just a goal, it’s a major priority for most organizations. This can be achieved with a clear understanding of the denial remark codes and proactive steps that speeds up the entire process of revenue cycle.

A denied claim is the one for which the Insurance Company refuses to make payment after it has been processed and reviewed since it doesn’t meet their payment criteria. It can be due to many reasons such as coding errors, missing documentation, lack of medical necessity, or policy exclusions.

Every payer will send an Explanation of Benefits (EOB) or Electronic Remittance Advice (ERA) that explains why the claim was denied. Even though the claim is denied by the payer we can appeal for it after identifying the reason for denial and correcting it.

In this blog let’s discuss on the common denial remark codes and suggestions on how to rectify them.

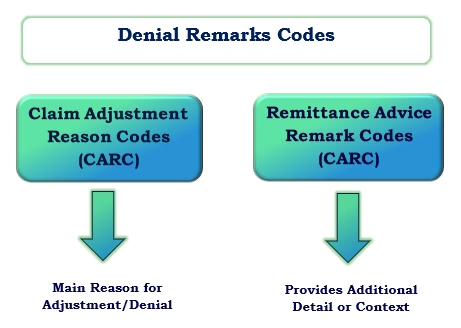

They are the standardized alphanumeric codes used by insurance companies to explain why a claim was denied or adjusted. In practice, it could mean the CARC, the RARC, or a combination of both.

The revenue cycle is the full process from patient registration to final payment. Denials can halt this cycle multiple times, leading to delays in reimbursement. Understanding these codes helps us to respond appropriately to the denied or rejected claims. It provides the clarity, needed for re-appeals and boost the revenue cycle efficiency.

Claim Adjustment Reason Codes (CARCs) and Remittance Advice Remark Codes (RARCs) are the specific codes that point out the category of the problem and tells what went wrong exactly.

CARC tells why a claim or service was adjusted or denied. For example,CARC 27 means “Expenses incurred after coverage terminated.”

RARC add extra context or clarification to a CARC. For instance, alongside CARC 27 , a RARC N290 means a “Missing or incomplete/invalid patient insured identifier.” It provides a more descriptive detail.

CARC explains why a claim or part of a claim was adjusted or denied. They are often paired with a two-character codes that assign financial responsibility for an adjustment on a medical claim. The common types are CO (Contractual Obligation), OA (Other Adjustment), PI (Payer Initiated Reduction), PR (Patient Responsibility) and CR (Correction and Reversal).

These are adjustments due to an agreement between the provider and the payer and cannot bill the patient for it. For example, if the billed charge is $150 and allowed amount as per the agreement is $100 the provider writes off the exceeded difference amount.

Adjustments that don’t fall under contractual obligations or patient responsibility, such as corrections or policy changes. For Example, Claim paid under a different benefit plan, or system correction, the payer reprocessed a claim due to an internal error such amounts are adjusted as OA.

Patients are responsible for paying this amount, such as copays, coinsurance, or deductibles. PR codes clearly show what you can bill the patient directly.

Example: Patient has a $30 copay or $200 deductible that hasn’t been met.

Reductions in payment when the payer reduces the payment for reasons such as medical necessity, bundling, or coding edits.

Used when reversing a previous adjustment or correcting a prior transaction.

These codes help to determine the appropriate action to be taken on a denial, such as whether to bill the patient, appeal the payer’s decision, or simply write off the amount. Correct interpretation prevents billing errors and compliance issues.

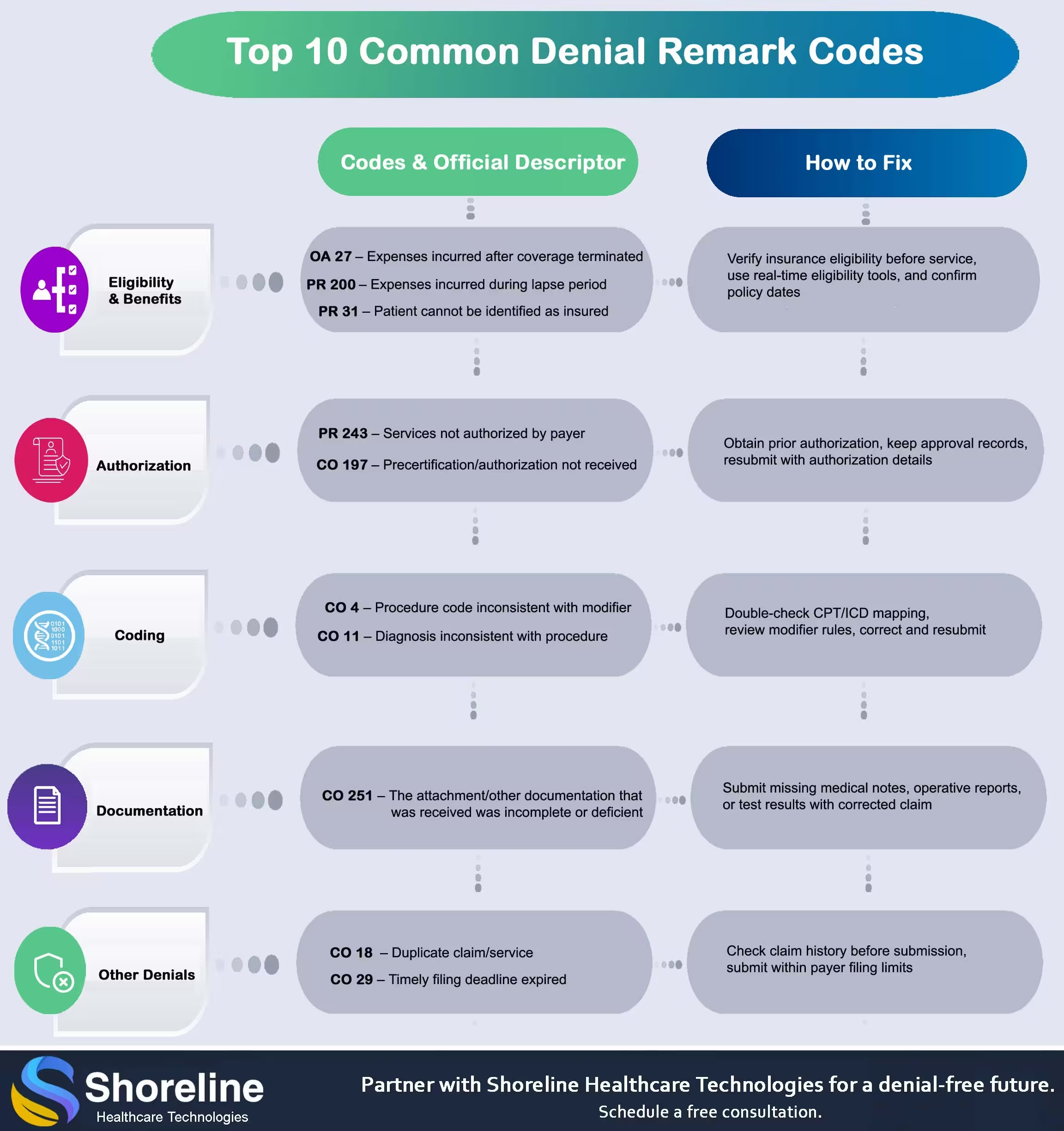

Let us discuss the most commonly occurring denials and their remark codes under each category and solutions to rectify them.

These types of denials occur due to insufficient or lack of patient’s eligibility verification. Having an efficient front-end management team reduces the occurrence of such denials.

This claim denial code is used to intimate that the service was rendered after the patient insurance policy’s termination. These types of denials have to be prevented because they’re hard to fight. This implies verifying the patients’ insurance benefits before the services are rendered, so that we can know about their insurance coverage status. Advice the front office staff to verify insurance status for every visit. This helps get the most up-to-date insurance information or determine whether the individual is a self-pay patient, enabling to collect payment at the time of service.

This refers to any claim charges made while the patient was suffering from an interruption of their insurance coverage. To rectify this remark code, the medical practice should verify that the patient's insurance is current, and resubmit all claims being denied as a result of this lapse in coverage. It is important that practices stay up to date on insurance verifications, so as to avoid losses due to denials. Staying organized and documenting all patient interaction, helps practices quickly and efficiently identify any issues related to insurance lapses or other denied claims. This allows them to mitigate potential losses and ensure timely payment processing.

This denied code is used when the payers couldn’t find the patient in its system under the given subscriber details. This may occur due to simple data entry errors or outdated information like typo or discrepancy in the patient's name, date of birth, or address on the claim compared to the information on file with the insurance company. It might also occur due to wrong submission of the claim to another insurance company that does not cover the patient at all. Always double-check the patient's demographic details and provide the exact information as appearing on their insurance card. Check with the payer for any discrepancies in their system and rectify it. Reach out to the patient to get the accurate, current information and update their records and resubmit the claim with the corrected information.

Getting a pre-authorization is one of the most important steps in the billing process. Each payer has their rules or guidelines that requires getting a prior permission before offering the services for some cases like high-cost diagnostics tests or surgeries. Without proper prior-authorization the claims will not be processed and will be denied or rejected.

This code is used when the payer requires prior authorization (PA) for a service or procedure, but no valid authorization is found in their system at the time of claim review. The various reasons for that can be

Always check with payer to confirm if the service requires prior authorization. If authorization exists, verify that the auth number matches. If no PA was obtained, request a retro-authorization (however only some payers allow this within a certain timeframe).

This is similar to PR 243 but under this we cannot bill the patient for the denied amount, it’s the provider’s responsibility. This happens when the provider has a contractual agreement with the payer to follow certain authorization rules.

Coding errors or missing modifiers is the major reason for claim rejection/denial. Always ensure to use the correct diagnosis code with relevant CPT codes and appropriate modifiers.

It indicates the wrong usage of modifiers with the CPT/HCPCS codes. Include modifiers wherever necessary (e.g., -25 for significant, separately identifiable E/M services also verify the modifier alignment with the procedure code according to CPT guidelines and payer policy. Use official CMS Modifier Guidelines to confirm correct usage. If a modifier is missing append it and resubmit the claim.

This is essentially a “medical necessity denial” and is reported when the diagnosis code submitted doesn’t justify the medical necessity of the service according to the payer’s coverage policy. Choose procedure codes that match the service provided.

We at Shoreline Healthcare Technologies recognize how much accurate billing impacts both provider revenue and patient confidence. Our team of certified experts ensure to give error-free claims on the very first submission, reducing the rate of denials

It means that the attached document is not sufficient to process the claim and needs extra details. Check whether the chief complaint and history of present illness are clearly documented and provided with supporting details. Gather complete and clear documentation from the medical record. Re submit the claim with corrected and complete documentation. For future claims, use a documentation checklist before submission.

This code means the claim was denied because the payer believes the same service was already submitted for the same patient, date, and provider. This may be due to

Verify if the service was already paid. If it’s a legitimate second service, add the correct modifier (e.g., -59, -76) and resubmit with an explanation.

This denial occurs when the claim was submitted after the payer’s filing deadline. Implement internal claim tracking team to check payer’s timely filing policy and submit within limits.

Navigating through these claim denial codes can have serious impact on the practice's resources. Outsourcing the revenue cycle management to Shoreline Healthcare Technologies offers numerous benefits. Our experienced denial management team knows the ins and outs of common denial remark codes, from explanations to rectifications and turns out all denials into reimbursements. By staying up-to-date on the latest coding guidelines and payer policies, we adhere to all compliances and minimize the errors. Our valuable insights help practices to maintain their financial stability and focus on patient care. With thorough, clear documentation, paying attention to small details and staying up to date we can minimize delays in payments and save valuable revenue.

Rejected claims, are those which are returned before processing due to incorrect or incomplete information and can often be resubmitted without a formal appeal. However, denied claims are processed and reviewed by the payer but haven’t issued the full or partial payment due to any mismatch in the payment criteria.

Both codes relate to missing prior-authorization, with PR 243 code we can bill the Patient but with CO 197 we cannot bill the patient and provider should write-off the amount as per payer-provider contract.

It is a two-character descriptor added to CPT/HCPCS codes to give extra details about a procedure without changing its definition. Incorrect usage or missing modifier can result in claim rejection/denial.

Yes, ShorelineMB.com is the official website of Shoreline Healthcare Technologies, a leading provider of medical billing and RCM services.

Sharanya brings clarity to the complexities of medical billing and healthcare regulations. With a knack for turning industry shifts into straightforward, actionable insights, her blogs help readers stay informed without the jargon.

Contact Shoreline Healthcare Technologies for Efficient Denial Management.